Anti Money Laundering Council

|

RCBC Chief Legal Counsel

|

Ramon Esguerra

William Go Lawyer

| |

Aside from its association in the Bangladesh controversy, an October 28, 2015 report supposedly by the Anti-Money Laundering Council (AMLC) also linked PhilRem to a supposedly anomalous fund transfer amounting to P100 million to a Hong Kong company involving Vice President Jejomar Binay.

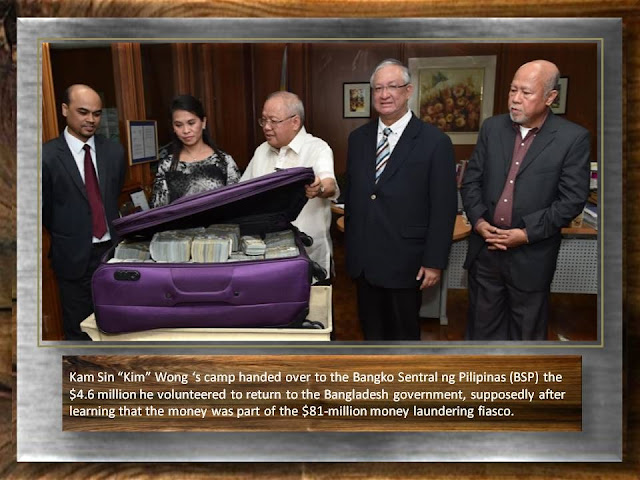

It filed similar charges of money laundering under Section 4 of the Anti-Money Laundering Act against businessmen Kam Sin Wong alias Kim Wong and Weikang Xu, and alleged that about $21.6 million of the laundered amount went to Wong and some $59.2 million to Xu.

It said that from the four fictitious accounts in RCBC where the $80,884,641.63 stolen money was deposited, $30.5 million was transferred to Philrem’s account.

“Upon instruction of Ms. Maia Santos-Deguito, PhilRem personally delivered a total of $18,000,000 and P600,000,000 to respondent Xu. The delivery was spread over several days from 5 to 13 February 2016,” it said, quoting a testimony from a PhilRem representative during the Senate hearing.

It further alleged that Philrem transferred another $28.7 million to Solaire casino, which later transferred the amount to a junker operator in the name of Xu, according to the casino’s corporate secretary Silverio Tan.

It told that Wong got P1 billion or about $21.6 million from the laundered amount through his firm Eastern Hawaii Leisure Company and personal bank account in the Philippine National Bank.

The council alleged that after PhilRem transferred P1 billion to Eastern Hawaii, Wong withdrew amounting to P900 million from his firm’s account and transferred it to his personal PNB account, from which he later withdrew P400 million.

“Foregoing considered, probable cause exists that respondents Kam Sin Wong aka Kim Wong and Weikang Xu violated Section 4 (a) and (b) of the Anti-Money Laundering Act of 2001, as amended, for having transacted and/or transferred, moved, acquired, possessed or used proceeds of an unlawful activity,” the complaint pointed out.

It earlier filed the same complaint against Deguito and four other respondents – Michael Francisco Cruz, Jessie Christopher Lagrosas, Alfred Santos Vergara and Enrico Teodoro Vasquez, the supposed owners of the bank accounts where the $80,884,641.63 stolen from the Bangladesh Bank by hackers went, which they included the complaint despite an initial finding that these last four names might be fictitious.

AMLC executive director Julia Bacay-Abad, said, they acted promptly after getting information on the suspicious movement of the $81 million, by getting in touch with the banks involved in the alleged money laundering anomaly last February 12 after which the concerned financial institutions submitted suspicious transaction report.

RCBC reportedly received a stop payment order as early as February 8.

Abad said officials of the Bangladesh Bank went to AMLC last Feb. 16 to submit documents on the $81 million fiasco.

|

Abad pointed out the AMLC received over 36 million covered transaction reports as well as 146,308 doubtful transaction reports in 2015 alone. “We are receiving millions of transaction reports and the AMLC cannot look into all those transactions,” she said.

She explained the Information Management and Analysis Group of AMLC only has 28 personnel and only nine were financial analysts.

After completing its initial investigation, the agency’s financial intelligence unit (FIU) submitted its recommendations to the AMLC last February 22.

She revealed the AMLC then forwarded the matter to the Office of the Solicitor General (OSG) which has to approve all the pleadings of the state.

She said the AMLC received the reply from the OSG for the petition to file a freeze order before the Court of Appeals (CA) at 3:30 p.m. of February 29 and it failed to meet the 4 p.m. deadline of the appellate court.

The CA issued the freeze order on the accounts involved on March 1.

However, the $81 million deposited in the four alleged fake accounts was withdrawn as early as Feb. 9.

Speeding up the process, she said there is a need to further amend the AMLA to put more teeth into the AMLC. Since the law was passed in 2001, the law has been amended thrice through RA 9194 in 2003, RA 10167 in 2012 and RA 10365 in 2013.

She pointed out the amendments should include casinos and real estate brokers in the list of covered institutions.

In a timeline submitted to the Anti-Money Laundering Council (AMLC) dated March 14, the RCBC report suggested that Deguito had vouched for the transaction, speedily administered the withdrawal of the money while intimating to other staff members in the branch on Jupiter Makati that she feared for her life and for her family.

On February 5 or the day the $81 million was wired to the accounts of Jessie Christopher Lagrosas ($30 million), Alfred Vergara ($19.999 million), Enrico Vasquez ($25 million) and Michael Cruz ($6 million), Deguito “facilitated the opening of the account of businessman William S. Go DBA Centurytex Trading at Jupiter BC,” said the report submitted to the AMLC.

|

RCBC chief legal counsel Macel Fernandez-Estavillo told the Senate that Torres “perjured herself” or lied by supporting Deguito’s claim that they gave the P20 million to Go.

She had earlier said that the bank found in an internal investigation that the account opening documents and the withdrawal slips for the supposed William Go accounts were to a "high degree of certainty" not signed by him, who has repeatedly denied having an account at the RCBC Jupiter branch. She added that Torres told bank auditors that the money was brought to Go's "Lexus SUV" and that she saw him sign the withdrawal slip.

Rizal Commercial Banking Corp. (RCBC) has terminated a branch manager Maia Santos-Deguito and her assistant Angela Torres for “violating bank policies and procedures and falsification of commercial documents,” particularly their alleged unauthorized fabrication of accounts where more than $81 million electronically stolen from Bangladesh ended up. Their termination came days after they testified before the Senate Blue Ribbon committee that their actions had the blessings of RCBC higher-ups.

“Deguito and Torres’ breaches facilitated the alleged laundering of $81 million of remittance that is now being investigated by the Senate and other government agencies. Appropriate charges in court will be filed by the bank against them by next week,” RCBC legal head Macel Fernandez-Estavillo said in a statement.

She said that more bank officials may face sanctions ranging from suspension to termination pending the completion of an internal investigation.

The two officials are also facing accountabilities for falsification of documents from businessman William Go whose alleged bank account part of the stolen money was deposited and later withdrawn.

|

He said that they are collating all documents connected to the dollar and peso accounts opened under Go’s name at the Jupiter branch, and readying the additional charges, reiterating that Go never consented to the opening of accounts on the said branch.

Esguerra said the charges are different from the falsification of documents earlier filed against Deguito before the Makati Prosecutors Office, which was in connection with the forging of Go’s signature in the withdrawal slip for P20 million.

He said their camp has requested documents from RCBC on the dollar and peso accounts in question to use them as a proof against Dequito.

He also denied Go had asked for 10 percent of the stolen funds but rather it was Deguito who offered Go P10 million for using bogus accounts opened in the Jupiter branch in his name and which were used in moving the $81 million, the lawyer said.

Pointing to the two sets of signatures. Esguerra said that Go’s genuine signatures are very much different from those on the account opening form. He said this was also RCBC’s conclusion, which engaged the help of handwriting experts from Truth Verifier Systems, Inc.

He added that Go has an existing corporate account only in RCBC-Trinoma Mall (Quezon City) branch.

Asked whether his client would sue RCBC, Esguerra said, “Yes, for consequential damages. They did not exercise due diligence in choosing their branch officers.”

On the statement of Sen. Serge Osmeña III that senators found Deguito to be a credible witness, Go’s lawyer said, “That’s their impression. But the better approach would be to look at everything, including documents. And a document has greater weight than a statement.”

As for the claim of Torres that she saw Go receive the P20 million while he was in his “dark gray Lexus sport utility vehicle,” Esguerra said this was contradicted by another Jupiter branch officer, Romualdo Agarrado, who had told senators that he saw the money loaded into Deguito’s car and that she drove off with it.

The lawyer admitted that his client owns a Lexus, “but it’s not dark gray, it’s light-colored, more like beige or champagne.”

|

Legend:

Jon Viktor D. Cabuenas, GMA News, PhilRem in the eye of a stormy money laundering controversy, Published March 31, 2016 5:40pm, Updated March 31, 2016 7:12pm, http://www.gmanetwork.com/news/story/561038/money/companies/philrem-in-the-eye-of-a-stormy-money-laundering-controversy

Jon Viktor D. Cabuenas, GMA News, Kim Wong turns over $4.6 million to Bangko Sentral for safekeeping, Published March 31, 2016 5:36pm, Updated March 31, 2016 10:38pm, http://www.gmanetwork.com/news/story/561040/money/companies/kim-wong-turns-over-4-6-million-to-bangko-sentral-for-safekeeping

WATCH: RCBC manager Deguito breaks down, fears for her life, ABS-CBN News, Posted at 03/14/16 5:45 PM, http://news.abs-cbn.com/video/business/v1/03/14/16/watch-rcbc-manager-deguito-breaks-down-fears-for-her-life

Jon Viktor D. Cabuenas, GMA News, Deguito named 2 senior RCBC execs who could be part of bank heist —Guingona, Published March 18, 2016 7:25am, Updated March 18, 2016 9:15am, http://www.gmanetwork.com/news/story/559507/money/companies/deguito-named-2-senior-rcbc-execs-who-could-be-part-of-bank-heist-guingona

Virgil Lopez/NB, GMA News, Kim Wong tagged as mastermind in $81-M laundering case, Published March 18, 2016 9:45pm, http://www.gmanetwork.com/news/story/559586/money/economy/nlex-sctex-integration-completed-ahead-of-holy-week

Virgil Lopez/NB, GMA News, Businessman William Go files raps vs. Deguito, Torres, Published March 18, 2016 9:44pm, http://www.gmanetwork.com/news/story/559586/money/economy/nlex-sctex-integration-completed-ahead-of-holy-week

Coconuts Manila March, Makati bank manager tags RCBC president's 'friend' in money laundering scandal, 15, 2016 / 09:53 PHT, http://manila.coconuts.co/2016/03/15/bank-manager-tags-rcbc-presidents-friend-money-laundering-scandal

Jonathan de Santos, Bank manager Deguito got 'laundered' money, RCBC officer says, (philstar.com) | Updated March 17, 2016 - 2:44pm, http://www.philstar.com/headlines/2016/03/17/1563880/bank-manager-deguito-got-laundered-money-rcbc-officer-says

Edu Punay, Christina Mendez, Lawrence Agcaoili, Jess Diaz, Ted Torres, Pia Lee Brago, (The Philippine Star), RCBC fires bank manager | Updated March 23, 2016 - 12:00am, http://www.philstar.com/headlines/2016/03/23/1565815/rcbc-fires-bank-manager

Jess Diaz, Iris Gonzales, Lawrence Agcaoili, Marvin Sy, (The Philippine Star), Bangladesh rejects Philrem’s P10-M restitution offer, | Updated March 22, 2016 - 12:00am, http://www.philstar.com/headlines/2016/03/22/1565426/bangladesh-rejects-philrems-p10-m-restitution-offer

Doris Dumlao-Abadilla, Jerome C. Aning, Philippine Daily Inquirer, 12:15 AM March 16th, 2016, RCBC pins down manager, Internal Report Says Deguito Got Help From Coworkers, http://newsinfo.inquirer.net/774085/rcbc-pins-down-manager

Coconuts Manila, Makati bank manager tags RCBC president's 'friend' in money laundering scandal, March 15, 2016 / 09:53 PHT, http://manila.coconuts.co/2016/03/15/bank-manager-tags-rcbc-presidents-friend-money-laundering-scandal

Osmeña raises flags on RCBC branch manager's actions, ABS-CBN News, Posted at 03/13/16 6:21 PM | Updated as of 03/14/16 12:26 AM, http://news.abs-cbn.com/nation/03/13/16/osmea-raises-flags-on-rcbc-branch-managers-actions

Maila Ager, Money Laundering: Where did $81 million go?, 11:01 AM March 14th, 2016, http://newsinfo.inquirer.net/773406/money-laundering-where-did-81-million-go

Analysis of the Issue

Maia Santos-Deguito claimed that the four accounts, which originally received the money from New York, were referred to RCBC by a certain Kim Wong – a friend of bank President and CEO Lorenzo V. Tan, which the latter denied saying he saw Wong on rare occasions over the past 12 years.[4] She said Wong was a valued client of the bank being a close friend of RCBC president and CEO Lorenzo Tan. During the open hearing, she said that Wong had referred all the accounts - whose holders were found to be fictitious - to hold the $81 million before the funds were consolidated into the account of businessman William Go, and laundered in casinos. She claimed that she met Wong through car dealer Jason Go when she was still with East West Bank. [5]

Evidently, the truth is suppressed here, a collision between Maia Deguito’s “Yes” and Lorenzo Tan’s “No” about Kim Wong as being referred by the latter who indeed become a “valued client” of the bank, not to mention that he’s a close friend. In my opinion, a “lady” manager would not jump from her branch to the main office just to pick him us a best choice to save face because after all there are other people in the branch where she could handpick and concentrate on, not unless if she has enmities against him.

Obviously, there is one among them who is repressing the truth to protect from potential unimaginable accountability that it brings upon to any corporation/individuals when convicted. I’m not a law graduate but if the interpretation of such an offense is literally understood in the stipulation below, then that’s really a big headache. The law says:[6]

Sec. 4. Money Laundering Offense

| |

Money laundering is a crime whereby the proceeds of an unlawful activity are transacted, thereby making them appear to have originated from legitimate sources. It is committed by the following:

| |

(a)

|

Any person knowing that any monetary instrument or property represents, involves, or relates to, the proceeds of any unlawful activity, transacts or attempts to transact said monetary instrument or property.

|

(b)

|

Any person knowing that any monetary instrument or property involves the proceeds of any unlawful activity, performs or fails to perform any act as a result of which he facilitates the offense of money laundering referred to in paragraph (a) above.

|

(c)

|

Any person knowing that any monetary instrument or property is required under this Act to be disclosed and filed with the Anti-Money Laundering Council (AMLC), fails to do so.

|

Sec. 14. Penal Provisions.

| |

(a)

|

Penalties for the Crime of Money Laundering. - The penalty of imprisonment ranging from seven (7) to fourteen (14) years and a fine of not less than Three Million Philippine pesos (PhP3,000,000.00) but not more than twice the value of the monetary instrument or property involved in the offense, shall be imposed upon a person convicted under Section 4(a) of this Act.

|

If I’ll take on Deguito’s word, it’s understandable that a referral from the big boss should be treated as VIP than undergo a massive scrutiny of his identity because that would appear as she’s not trusting her boss. On the other hand, if I’ll buy Lorenzo Tan’s argument, it’s either he’s protecting himself to be exposed as the negligent to save himself from huge accountability that he referred a wrong person and clueless that the person he referred to is a money launderer, or he’s really telling the truth, or it’s otherwise.

In an exclusive interview with ABS-CBN News,[7] Deguito claimed that RCBC president and CEO Lorenzo Tan knew about the illegal transaction involving a man named Kim Wong, that Wong then referred to her "four persons who opened on May 2015 the other bank accounts linked to the scam: Michael Francisco Cruz, Jessie Christopher Lagrosas, Alfred Santos Vergara and Enrico Teodoro Vasquez." She said that she met the five individuals in Solaire Hotel as part of her marketing function to go out of the office as branch manager.

According to her, these five individuals were referred to her in Solaire, wherein she facilitated the forms which were submitted back to her together with all the supporting documents. When asked why she agreed to meet the men at Solaire and not at their bank, Deguito replied that Kim Wong is a known close friend of the president of the bank (Lorenzo Tan), that people like that are entitled to special accommodation, she added. Conversely, Tan denied[8] this and said that he does not know (Maia Santos-Deguito) personally, telling that as president of RCBC he does not engage himself in the opening of accounts, knowing the client and his source of income among other things as required by government rules, and crediting and debiting funds. He added that the branch manager oversees these things and did not refer anyone to her for the opening of accounts even. He also stated that if he did not know her personally, how could he provide her guidance on how to answer a memo from management asking her to explain everything that is now coming out in the media in a level of detail that he could not have been familiar with as CEO?

In the second disagreement of statements, it is logical when Deguito spoke of her marketing function that requires of going out the office to meet VIP for transacting business because this normally happens in marketing of which I’m aware of because I am a marketing graduate and has been in sales almost half of my life. But I can’t buy Tan’s explanation because while it’s true that the branch manager oversees these things that pertain to the opening of accounts, he as a president of the company can refer his common friends, acquaintance, relatives whom he bumps into because that’s normal in the business, especially if the amount involved is extremely huge because that would mean additional yield to the company he’s representing.

The report further noted: "Deguito also said that the wire transfer of the illegal funds first passed the RCBC main office before it reached the accounts in the bank's Jupiter Street branch. She said she even questioned their head office about the sudden remittance of the huge amount. The RCBC Settlements Division, however, allegedly did not raise red flags on the transfer." It may be recalled that last Mar 10, Tan already issued a statement denying Dequito’s allegation that he played a role in the opening and subsequent use of the banks accounts allegedly for money laundering.

If Deguito’s statement is true that the bank did not raise red flags on the transfer despite of her questioning their head office about the sudden remittance of the huge amount, then Angela Torres’ statement claiming that Go was able to withdraw P20 million from the peso account which she and bank messenger, Jovy Morales loaded into his Lexus car outside the Jupiter branch on February 5,[9] can be a link with the former’s testimonial during the open hearing which says that Wong had referred all the accounts - whose holders were found to be fictitious - to hold the $81 million before the funds were consolidated into the account of businessman William Go, and laundered in casinos.[10]

In the last hypothesis, that would be boiled down again to trust issue. Since Wong is a valued client, the bank’s president’s referral and a close friend, it’s plausible that trust has already been built. If it’s true that William Go and Kim Wong are the culprits, then these people used this established trust as a conduit towards a more gigantic scheme.

Lastly, Romualdo Agarrado, RCBC Jupiter Branch Customer Service Head testified that on February 5 - the day when RCBC said $22 million was put into the Go account - Deguito's assistant, Angela Torres, requested P20 million from the bank's cash center, which was delivered by armored car. He said that the teller then put the money in a box, which was brought to Deguito's office. He said the branch messenger, a certain Jovy Morales, then looked for a paper bag to put the money in and then brought it to the branch manager's car, asserting that he personally saw it because I was sitting in the table facing the door of the branch.[11] He alleged that he saw Deguito loaded the money into her car and drove off with it.[12]

|

PAGES

|

||

No comments:

Post a Comment